Plan for your future

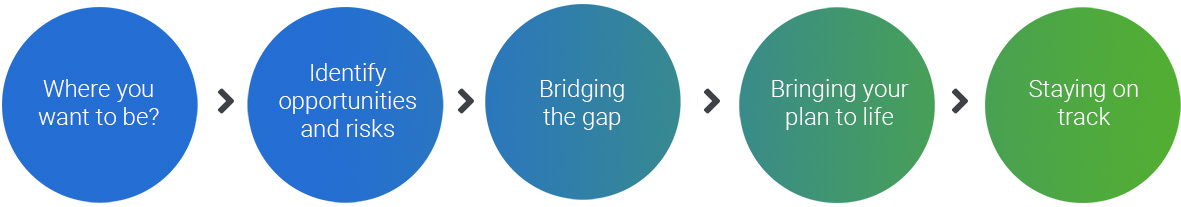

We are often asked “What is Financial Planning?” by people who are considering using a financial planner for the first time. We have prepared the following summary to answer that exact question. In essence, we have identified the 5 most important steps that are involved in preparing and implementing a successful personalised financial plan based on your own needs, goals and aspirations and concerns.

Identifying where you want to be

We help you identify your financial and lifestyle goals and explain the financial planning services we offer to help you achieve them.

Considering opportunities & risks

Great personal advice starts with us having an understanding of your current situation. This can be done in several different ways depending upon your own preferences and detail requirements. Completing a Financial needs analysis is our most efficient way of gathering relevant information about your current position and concerns for the future. Building a Mind Map is an excellent method of developing a significantly deeper understanding of what is important to you and more importantly, why. We then explore the options you could use to reach your goals.

Bridging the gap

Based on the research we have conducted, we will recommend strategies to bridge the gap between where you are now and where you want to be.

Bringing your plan to life

We work closely with you to implement your financial plan. We help you so that your strategy is implemented efficiently.

Staying on track with regular ongoing advice

Time goes on and circumstances and needs change. The final step in our advice process ensures your financial plan remains on track, by providing you with regular ongoing financial planning advice. We design an ongoing service programme to ensure your plan remains up to date as your life changes and so you can obtain the benefits of ongoing reliable advice.